Support and Resistance

These two are probably the most important concepts in technical analysis. Basically, support and resistance are points or levels where forces of supply and demand meet.

As the prices go down, the demand for one given instrument tends to increase, because it attracts buyers interested in cheaper prices. At some point, the demand for the given instrument will outperform the supply for it, making the price bounce back up from certain zone (support). This makes the price go up again, but there is again a certain zone in which the price is so high that it attracts more sellers interested in selling high. At this point, the supply for that instrument will outperform the demand for it, making prices to bounce back down again (resistance).

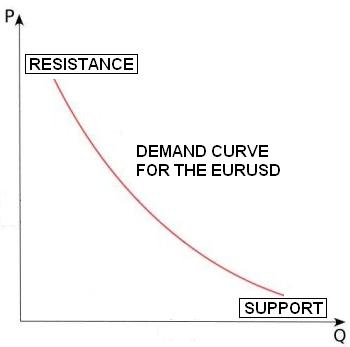

Every one of us (at least must of us) have seen a demand curve back in our school and college days, so it will probably be a good idea to illustrate these two concepts with the famous curve.

Take a look at the following image.

[Image 3]

Imagine that curve is the demand for EURUSD, as the price goes down it will attract:

Buyers interested in low prices (buying low to sell high), and

Traders already short looking to take profits on their short positions.

These two forces will make the market to go back up again because the demand for it will increase, that zone is what we call “support”.

As the prices go up again, it will attract:

More sellers interested in high prices (to sell high and buy back at low prices), and

Traders already long looking to take profits on their long positions.

Those two forces will make the price go down again, that zone is what we call “resistance”.

And what happens when the market breaks one support or resistance? Ahh Sharp eye… we will get to that. But for now, here is a brain feeder for you.

Brain Feeder 1

How do you think the market behaves when the supply for one currency meets the demand for it over a considerable period of time?

Remember, support and resistance are more like “zones” rather than “levels”. So even if we refer to “support and resistance levels”, from now on they are really zones.

Now let’s get to some real life examples.

Support Zone

A support is a price level or zone in which the demand for one given instrument outperforms its supply, preventing prices from falling below this zone. It “supports” the price from falling below it.

[Chart 4]

In this chart, the support zone is marked by the black line. There were several points where the market was stopped from falling below. At this level, the buyers (bulls) outperformed the sellers (bears) and the buying becomes so strong that it prevents the price from falling further.

Resistance Zone

A resistance is a price zone in which the supply for a given instrument is greater than the demand for it. This prevents prices from going above this level. The price “resists” going higher.

[Chart 5]

In the chart above, the level at which the bears outperformed the bulls is clearly seen and it’s market with a black line. At this level, the selling (product of traders attracted by the high prices and traders closing long positions thus selling back their trade) is so strong that it prevents the price from reaching higher levels. At this zone bears outperform bulls.

NOTE: Support and resistance levels are only considered to be broken when there is a sustained break, otherwise the level is considered intact, so when prices break through any important level and bounces back quickly (like the third peak on chart 2), the important level is still considered valid.

This takes us to our next concept…

Sustained Breaks

A sustained break happens when the prices are traded above the resistance or below the support zone for several periods. Should this happen, the old resistance now becomes an important support (in the case of a break “up”) or the old support becomes an important resistance (in a break “down”).

Below are two examples that picture these scenarios

Support zone becomes a resistance

[Chart 6]

The support zone is clearly seen at the left hand side of the chart, the price is rejected from that zone at least two times. Once the market breaks the support zone and continues to trade below the support zone it is considered a sustained break. The market goes down and retraces again to the support zone which is now a resistance zone. The price action gets rejected once, and on the last part of the chart, the market approached again to the resistance zone and it should be rejected again as it is now a resistance zone.

Resistance zone becomes a support

[Chart 7]

Here the sustained break happened when the market traded continuously above the resistance zone, as we can see the resistance zone became a support zone preventing the market from falling below it. This creates a possible buying opportunity.

When the price of a certain market breaks the support or resistance level, the balance between supply and demand has changed. When the price breaks an important support level, what investors thought to be a low price, now becomes a high price. When the price breaks an important resistance level, what was thought to be a high price, becomes a low price.

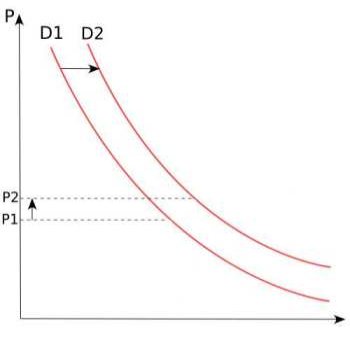

In terms of the demand curve this is what happens when there is a break of a resistance zone:

[Image 4]

There is a shift to the right in the demand curve when there is a break of an important level. “The balance between demand and supply changes”, what was once considered “high”, is now considered “low”.

Brain Feeder 2

We just saw what would happen to the demand curve once the market breaks a resistance zone, but what would happen if the market breaks a support zone?