Important Candlestick Considerations

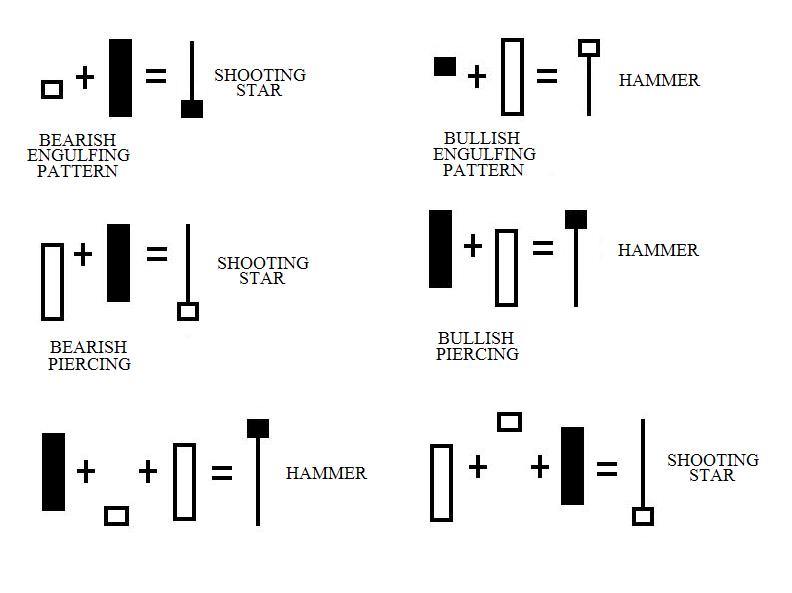

When taking into consideration the candlesticks that form these last three patterns (piercing, engulfing and stars), you will realize that they form an important candlestick. If we take the open price of the first candlestick, the closing price of the last candlestick of the pattern and the high/low of the entire pattern, we will arrive at an interesting conclusion.

[Image 1]

They all make either a hammer or a shooting star. The point here is that what we are really looking for is the price behavior, not the patterns itself. We are interested in price action, or more precisely, how do bears and bulls react at certain levels and when do they feel more comfortable entering the market.

And this is exactly what candlesticks show us, the psychology behind any price movement, who is winning and more importantly who is more likely to win, so we can take our part in the market and profit from it.

The patterns shown here figure between the most important patterns concerning candlesticks. These ones are also the most important when it comes to the trading system we use.

There are other patterns, but at the end, they all follow the same mechanics of the patterns shown here.

As in any other charting approach, there are also some limitations that occur as a result of candlestick usage.

Another Consideration: they appear on every timeframe.

Candlestick Limitations

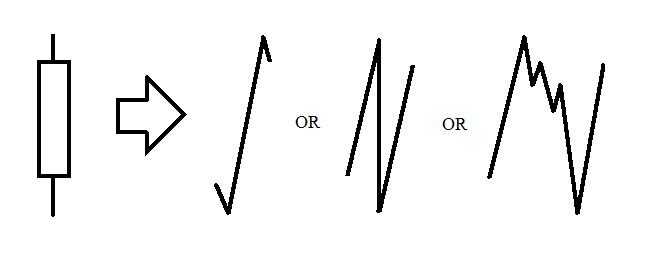

1. Candlesticks do not tell us the sequence of price, did it go to the highs first and then to the lows, or the other way around.

[Image 2]

2. Most candlestick patterns need a prior trend and some kind of confirmation in order for the pattern to be complete. They need a prior trend in order to either be reversed or continue it. Also a confirmation, usually formed when the losing group (in an uptrend the bulls and in downtrends the bears) close out their positions when they become aware the other group has won.

3. They need some human interpretation, and as humans, we all make mistakes. But we also learn, and as we gain experience we will get to know each pattern better.

There is also an important remark to be made. The Forex market barely gaps (most charting packages show no gaps). For this reason, we need some flexibility when it comes to candlestick pattern interpretation and recognition.

Remember, what we are really looking for is price behavior, price action, not the pattern itself.

Understanding candlesticks is very important because we could use this in combination with other methods, as we will see later on. We will also talk again on price behavior in future lessons.