Major Candlestick Reversal Patterns

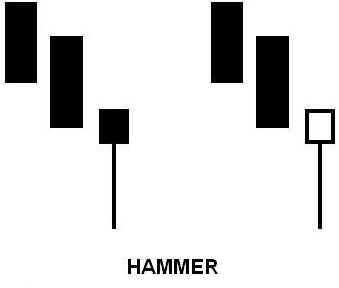

Hammer

In the image below, the hammer pattern is represented only by the last candlestick of the illustration.

[Image 1]

Formation

Hammers have small bodies and long lower shadows (or wicks). It must have little or no upper shadow. The size of the lower shadow should be at least twice as big as the size of the body. The color of the body is not important, however a hammer with a white body (hollow) is considered slightly more bullish than a hammer with a black body (filled). Hammers are formed in downtrends or downside movements.

Psychology behind the Hammer and Example

In a downtrend or a downside movement (where bears have control over prices), a hammer indicates that at certain point buyers took command of the market attracted by lower prices. Bull aggressive buying plus bears taking profits in their short positions reduce the bearish sentiment, signaling a possible trend reversal or correction. Following candlesticks should be used as a confirmation.

Hammers are signals to go long!

Hammer in Action

[Chart 1]

In this chart (USDCHF 1 hour chart) the hammer bulls start opening long positions aggressively creating enough pressure to make the market head up (yellow box).

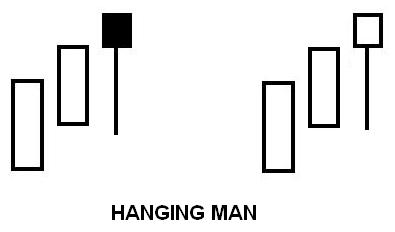

Hanging Man

In the image below, the hanging man pattern is represented only by the last candlestick of the illustration.

[Image 2]

Formation

Hanging Mans (as well as hammers) have small bodies and long lower shadows and the size of it should be at least twice as big as the size of the body in order to be a valid signal. It must have little or no upper shadow. The color of the body is not relevant, however a hanging man with a black body is slightly more bearish than a hanging man with a white body. Hanging Mans are formed during uptrends or upside movements.

Psychology behind the Hanging Man and Example

In an uptrend or upside movement (where bulls have control over the market), a hanging man indicates that as the prices go up bears are feeling more and more comfortable taking short positions that high. Although bulls finally take command of the market, it is known that bears feel optimistic at those levels and might signal a trend reversal, correction or consolidation periods.

Hanging mans are signals to go short!

Hanging Man in Action

[Chart 2]

In this daily EURUSD chart, the hanging man appears at the top indicating bears are felt comfortable taking short positions that high. It has a small upper shadow and a long lower shadow falling inside hanging man criteria. Although the market has not moved much from (yet) from the signal, it now has a slightly bearish sentiment and this can produce a trend reversal, or a possible correction or consolidation period.

Brain Feeder 1

Wait a minute (you should ask) so what you are saying is that hammers and hanging mans are exactly the same pattern? Yes, that’s right, by now you should know the difference between those two but there are other conclusions you can take based on this. Give it some thought and try to arrive at your own conclusions.

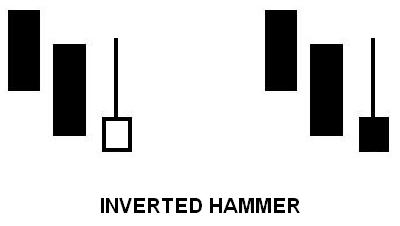

Inverted Hammer

In the image below, the inverted hammer pattern is represented only by the last candlestick of the illustration.

[Image 3]

Formation

Inverted hammers usually have small bodies, long upper shadow (at least twice as big as the size of the body) and a small or no lower shadow at all. The color of the body is not relevant, however an inverted hammer with a white body is considered slightly more bullish than inverted hammers with black bodies. Inverted hammers are formed during downtrends or downside movements.

Psychology behind the Inverted Hammer and Example

In a downtrend or downside movement (where bears have control over the market), an inverted hammer indicates that as the prices go down bulls are feeling more and more comfortable taking long positions that low (trying to buy low and sell high afterwards). Although bears finally take command of the market, it is known that bulls feel optimistic at those levels and might signal a trend reversal, correction or consolidation periods.

Inverted Hammers are signals to go long!

Inverted Hammer in Action

[Chart 3]

In the USDCHF chart above, the inverted hammer is identified in the yellow box. It has long upper shadow and no lower shadow and it was formed in a downside move. In this pattern, bears notice bulls are feeling more and more comfortable buying at current levels.

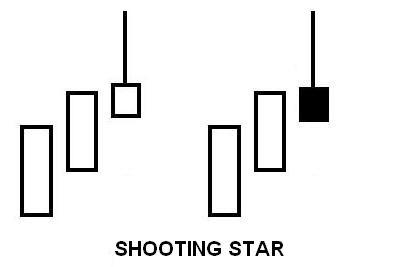

Shooting Star

In the Image below, the shooting star is represented by the last candlestick of the illustration.

[Image 4]

Formation

Shooting Stars have small bodies and long upper shadows (or wicks). It must have little or no lower shadow. The size of the upper shadow must be at least twice as big as the size of the body. The color of the body is not important, however a shooting star with a black body (filled) is considered slightly more bearish than a shooting star with a white body (hollow). Shooting stars are formed in uptrends or upside movements.

Psychology behind the Shooting Star and Example

In an uptrend or an upside movement (where bulls have control over prices), a shooting star indicates that at certain point sellers took command of the market attracted by higher prices. Bear aggressive selling plus bulls taking profits in their long positions reduce the bullish sentiment, signaling a possible trend reversal or correction. Following candlesticks should be used as confirmation.

Shooting Stars are signals to go short!

Shooting Star in Action

[Chart 4]

In this chart we see the shooting star after an upside movement, at that point bears are feeling comfortable taking short positions making the price quickly fall back down. This creates a “bearish” environment scaring longs and making them take profits.

Engulfing Reversal Pattern

In the image below, engulfing patterns are represented by the last two candlesticks of the illustration.

Formation

Engulfing patterns consist of two candlesticks. The first one is usually a small candle, and must be in direction of the prevailing trend (in an uptrend the short candlestick must be white and in a downtrend the candlestick must be black) while the second candlestick must be against the prevailing trend and is usually a long candlestick. Candles should have little or no shadows at all. The body of the second candlestick must cover or embrace the body of the first candle (shadows are not taken into consideration).

Psychology behind the Shooting Star and Examples

In a downtrend or downside movement where bulls have control over the markets, a bullish engulfing pattern indicates that bulls finally took total control over prices, they were attracted by the lower prices (and intend to sell back at higher prices) and pushed the market up above the open price. This could signal a trend reversal, a correction or a consolidation period.

In an uptrend or upside movement where bulls have control over prices, a bearish engulfing pattern indicates that bears finally took total control over the market; they were attracted by the higher prices and pushed the market down below the open price. This might signal a short-term reversal pattern as clearly bears or sellers have taken control of the market. .

Bullish Engulfing Patterns are signals to go long!

Bearish Engulfing Patterns are signals to go short!

Bullish Engulfing in Action

[Chart 5]

In the 5 min EURJPY chart a bullish engulfing pattern appears at the bottom of the range signaling a possible change in direction. The market goes up because of the bullish sentiment at lower prices. Bears notice bulls are really confident at those levels.

Bearish Engulfing in Action

[Chart 6]

In the AUDUSD 5 min chart, an engulfing pattern appears at the top of the range signaling a “change in direction”. Remember that reversal pattern not always forecast trend reversals, correction or consolidation periods are always a possibility.

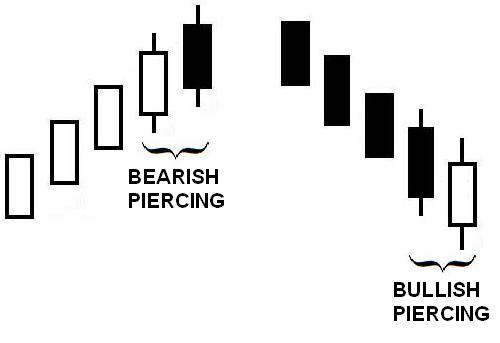

Piercing Reversal Patterns

In the image below, piercing patterns are represented by the last two candlesticks of the illustration.

[Image 4]

* The bearish piercing pattern is also called “Dark Cloud Cover”. For the sake of simplicity, in this course we will always refer to this pattern as bearish piercing pattern.

Formation

Piercing patterns, as engulfing patterns, are also made from two candlesticks. Both candlesticks should have long bodies and small or no shadows. The first candlestick must be in direction of the prevailing trend and the second against it. The further the second candle goes against the trend the more significant the pattern is. Candlesticks could have small or no shadows at all.

Psychology behind Piercing Patterns and Examples

In a downtrend or downside movement where buyers have control over the markets, a bullish piercing pattern indicates that buyers finally took total control over prices, they were attracted by the lower prices and pushed the market up near the highs of the day. This could signal a trend reversal, a correction or a consolidation period.

A bearish piercing pattern, or most commonly called dark cloud cover indicates that bears liked to sell on those higher prices, gaining temporary control. If the move is strong enough, bulls will close their longs making the price sell off. The close price of the second candle must be below the midpoint of the first candle body.

Bullish Piercing Patterns are signals to go long!

Bearish Piercing Patterns are signals to go short!

Bullish Piercing in Action

[Chart 7]

Hey, forget about the red box! We will get to that a few lines below. The bullish piercing pattern at the yellow box illustrates what the balance of supply and demand in this scenario: bears make a final push down, but bulls take command of the market pushing them up again.

What’s the red box?

It was the result of the Interest rate announcement from Canada. Consensus was no change but the Bank of Canada decided to cut .25%, it’s a 100 pip 5 min candlestick.

Bearish Piercing in Action

[Chart 8]

This is a valid bearish piercing pattern at the GBPUSD 30 min chart. Small shadows, first candle in direction of the movement and second candles against it. This pattern marks the end of the retracement.

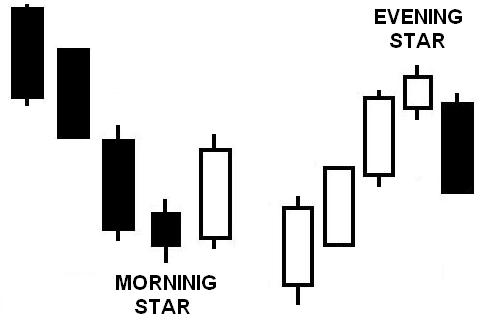

Morning Star & Evening Star

In the image below, morning and evening stars are represented by the last three candlesticks of each illustration.

[Image 5]

Formation

Morning and evening stars are made from three candlesticks. The first candlestick is always in the direction of the trend or current direction, the second candlestick could be a black or white one while the third must be against the prevailing trend or direction. Usually candlesticks in these formations have small or no shadows at all.

Psychology behind Evening and Morning Stars and Examples

The morning star pattern begins with a long bearish candlestick or big sell off (in direction of the prevailing trend). At the second candle, the bears are not sure anymore about the downtrend continuing its path. At this point, the buyers feel a little stronger than before. Buyers take total control of prices on the next candle making the market rally. The closer the candlestick closes from the first candlestick open price, the stronger the pattern.

Evening stars begin with a long white candlestick in direction of the prevailing trend. At this point, the bulls are still confident about the uptrend. At the next candle though, the bears start selling attracted by the higher prices. This candle represents a short period of indecision or a fierce battle between bulls and bears. On the third candlestick, bears take total control of the situation making the price sell off. The larger the third candle is, the stronger the reversal.

Morning Stars are long signals.

Evening Stars are short signals.

Morning Star in Action

[Chart 9]

In this USDCHF 1 min chart we see two morning stars patters that finally capped the downside movements. The trend wasn’t reversed, at least there some support is found around those levels.

Evening Star in Action

[Chart 10]

GBPJPY 1 min chart, the evening star at the beginning of the chart makes the market head down to reach lower levels. Bearish pressure is self evident: bears start selling and bulls take profits (sell back), this makes the market drop like a rock.

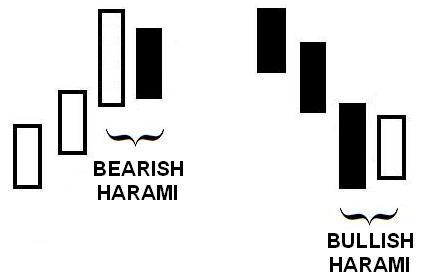

Harami Reversal Patterns

In the image below, Harami patters are represented by the last two candlesticks of each illustration.

[Image 3]

Formation

Both, bearish and bullish harami are made from two candlesticks. The first one is always a large candlestick in direction of the trend or current move and the second one against the direction of the trend or current move. Candlesticks could have small or no shadow at all. The body of the second candlestick must be inside the body of the first one.

Although the size of the body of the second candlestick is smaller than the size of the first one, it should be “larger” than usual.

Psychology behind Bearish and Bullish Harami and Examples

In the bullish harami, bulls stop bear dominance and take temporary control over the market. The first candlestick of the bullish harami is the final push of bears while the second one means bears are feeling more confident about further upside movements.

In the bearish harami, bears step in after a high volume bull push. Prices are high enough to start opening their short positions. The closer the second candlestick closes to the open of the first one, the stronger the short sentiment.

Bullish Harami are long signals

Bearish Harami are short signals

Bearish Harami in Action

[Chart 5]

As we have mentioned before, reversal patterns not only signal trend reversals, they also signal possible retracements and consolidation periods. In this case, the harami pattern signals a correction period. Now, take in consideration this is a weekly chart, from the top of the pattern to the bottom of the retracement there are around 500 pips.

Bearish Harami in Action

[Chart 6]

In the USDCHF 4H chart above, a bearish harami pattern appears after the retracement. It could signal the end of the retracement; traders could resume their short positions.

Brain Feeder 2

What’s the difference between Harami and Engulfing Patterns?